Seizing opportunities

Corporate sustainability and responsibility for environmental protection, social concerns and ethical corporate governance are becoming increasingly important. In order to promote sustainable business, the EU has introduced regulations as part of the European Green Deal that affect almost all organisations: from family enterprises to listed groups, investors, the public sector and foundations. Our experts support you with individual, interdisciplinary advice and help you to meet the regulatory requirements and successfully anchor them within your business strategy.

Talk to us directly: esg@fgs.de

Our expertise at a glance

ESG in transactions

- Integrating ESG criteria into selection processes

- ESG due diligence

- Warranty and indemnity clauses

- Eliminating ESG risks post-closing

ESG in corporate governance

- ESG concerns in corporate governance

- Review of existing corporate governance structures

- Sustainable shareholder activism

- Say on Climate initiative

ESG in supply chains

- Compliance with duties of care in the supply chain

- Identifying risks of human rights violations

- Documentation obligations

ESG in sustainability information

- Determining content requirements for ESG reporting

- Review and further development of compliance systems

- Determining ESG-reportable key figures

- Preparing and reviewing sustainability reports

ESG in Tax Compliance

- Structured risk identification and assessment (risk-control matrix)

- Developing an appropriate Tax CMS structure and process organisation

- Setting up a reporting system and notification system for compliance breaches

- Ensuring tax data compliance (GoBD)

ESG in sustainable finance/responsible investment

- ESG in capital market communications (e.g. securities prospectuses, ad hoc announcements)

- ESG investment strategies

- Classifying sustainability reports

CSRD: Briefly explained

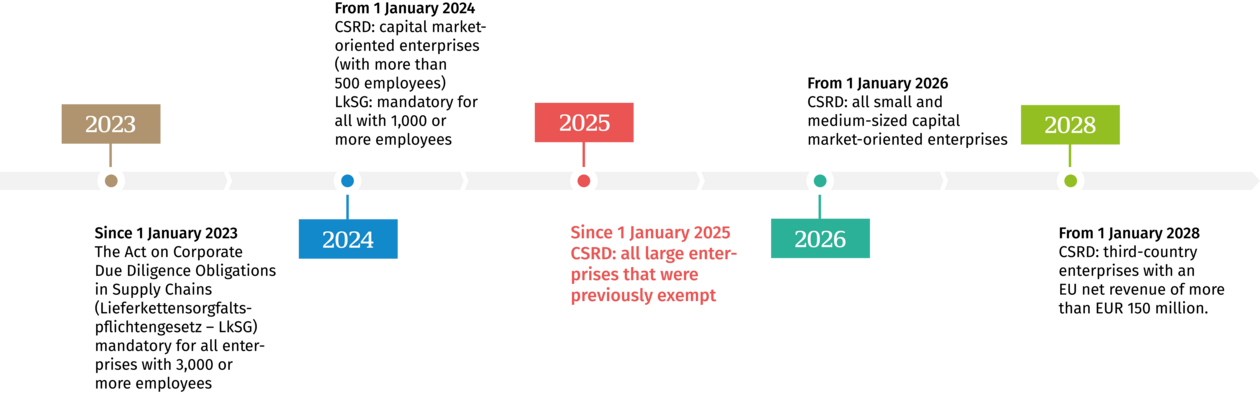

The Corporate Sustainability Reporting Directive (CSRD), a directive of the European Union on corporate sustainability reporting, affects firms and groups that meet two of the following three criteria on two consecutive reporting dates: Balance sheet total of 20 million euros, net sales revenue of more than 40 million euros or more than 250 employees, regardless of their capital market orientation. If small and medium-sized enterprises are capital market oriented, they also fall under this regulation. In Germany, about 15,000 enterprises are affected by this directive. The CSRD places aspects of sustainability in reporting largely on an equal footing with non-financial criteria. For most enterprises, the CSRD will become relevant from 2025.

CSRD: The countdown is on until 1 January 2025

- 00Days

- :

- 00Hours

- :

- 00Minutes

- :

- 00Seconds

Questions & Answers: CSRD

Keep up to date

Keep up to date and sign up to receive regular updates on selected subjects and events. Choose which issues you are especially interested in.

Sign up